Olivier has been Accountancy Europe’s CEO since 2006. He benefits from a diverse professional experience, having been a public prosecutor in France, a director with PricewaterhouseCoopers, a board member of the European Policy Centre, a director of XBRL international and a business and policy consultant. He regularly speaks on issues related to European affairs and the impact of technology on accountancy. A lawyer and economist by training, Olivier started his professional career in equestrian sports (jumping).

Non-Financial reporting makes sustainable finance possible

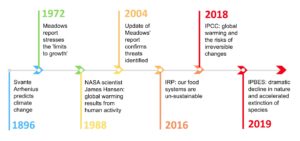

From climate deterioration and ecosystem failure to societal strife and geopolitical tensions, people from business, politics and civil society see that radical change is becoming critical. Indisputable scientific evidence shows that continuing endless economic growth is suicide. This means we must all act now.

Measuring environmental and social impacts is the first step to correct market failures that are destroying our planet. Reporting on these impacts and on business’ governance and strategy helps to better identify long-term risks and make sustainable business decisions. The information needs to be reliable as well. Professional accountants and auditors are experienced in non-financial information (NFI) reporting and assurance for companies and public sector organisations. The latter often represent around half of EU Member States’ economies. Accountants play an instrumental role to support the necessary shift to a circular economy.

Non-Financial reporting is still evolving

There is much potential for effective NFI reporting to bring greater transparency. This would allow decision-makers to adopt sustainable strategies, investors to make informed investment decisions and government leaders to develop appropriate public policies.

However, there are now hundreds of initiatives on what, and how, NFI should be reported. which leads to confusion and feeds the potential for greenwashing. Organisations can ‘framework shop’ and use (parts of) any NFI framework that might allow it to disclose only the positive side of the story. For an effective response to these global issues and stakeholder demands, we need to improve NFI reporting globally.

Getting to Better non-financial reporting

In Europe

The European Commission (EC) has recently announced its plans to develop European non-financial reporting standards. The intention is to build on the existing reporting initiatives, using the elements that work best.

As part of the Green Deal, the EC has opened a consultation to revise the Non-Financial Reporting Directive (2014/95/EU). Accountancy Europe has recommended five steps to strengthen non-financial reporting requirements in this Directive. Specifically. we see the need to:

- Expand the scope beyond large publicly listed entities

- Indicate a minimum set of mandatory reporting criteria

- Require companies to disclose NFI in the annual management report

- Introduce minimum reporting criteria for forward-looking disclosures

- Ensure the reliability of reported information

We urge the EU to take a clearer direction to encourage the development of NFI reporting in Member States.

In the world

Shareholders and stakeholders are realising that non-financial reporting reveals more insights than financial reporting alone and that only integrating the two makes sense. As part of its series of thought-leadership discussion papers that aims to stimulate policy debates (Cogito), Accountancy Europe published Interconnected standard setting for corporate reporting. This Cogito paper envisions a solution that would:

- address urgent global issues and provide a core set of global metrics for NFI

- make best use of existing structures and address broader stakeholder needs

- provide an effective connection between financial and non-financial reporting, to enhance companies’ ability to create long-term value

Ensuring the credibility of Corporate Reporting

NFI Assurance

With growing interest in NFI, more and more investors and other stakeholders call for independent assurance on NFI. However, NFI reporting is not yet subject to the same level of assurance as financial information. As NFI reporting evolves, it is important to ensure that the information is verifiable or can be verified in the future. We have offered advice on how to approach NFI assurance. As the demand for assurance on NFI has been growing steadily, we have shown that the practice still varies across Member States.

Corporate governance

Accounting and auditing serve better corporate governance. Transitioning to a carbon free and sustainable economy, requires that corporate governance centres on sustainability. Boards have the power to start this change and make sustainability the cornerstone of business decisions. Policymakers and regulators also must play a role in shaping how business is done. Another one of our Cogito papers suggests ten ideas to help boards, policymakers and regulators undertake the necessary changes to become sustainable.

Conclusion: act now!

Good business decisions start with reliable information. The accountancy profession can help companies make the right changes to reduce their environmental footprint – and costs. As businesses change their benchmarks for success, accountants contribute by measuring impacts, disclosing information, and adding credibility to what is reported.

We aim to achieve better non-financial reporting and support integrated reporting. We are pleased to see that the EU’s corporate reporting agenda is following the same lines.

Our economy brings increasing development and wealth but also causes natural resource depletion, pollution, overconsumption and social unrest to a level that is not sustainable anymore. An unprecedented scientific consensus shows that the clock is dangerously ticking. The only way forward is changing how the economy operates.