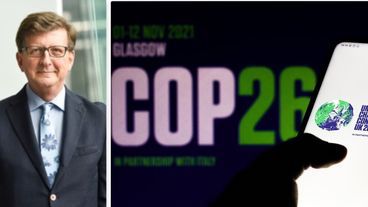

With COP26 approaching fast, the world will look to governments for leadership. People expect us to do what it takes to meet the challenges that affect every person and country on the planet.

The EU has been spearheading the global fight against climate change. We are committed to the goals of the Paris Climate Agreement, to becoming a sustainable economy and turning climate-neutral by 2050.

And we take these commitments very seriously.

How can we make sure of meeting them?

Answer:

We recently proposed a string of measures designed to reach our ambitious targets, across all sectors of the economy. we will come with more later this year.

But it will not be cheap. It will also require an entire rethink of our economy and of how we invest.

Achieving our higher 2030 target of cutting emissions by 55% calls for additional annual investments of some €355 billion over the next decade. This is in addition to around €130 billion that we will need for other environmental goals.

This is why we devised the Sustainable Europe Investment Plan.

Despite the pandemic’s disruptions, its overall implementation is on track. The plan gives us real financing clout – at least €1 trillion over the next decade. In the EU budget, we have raised the share of climate spending from 20% to 30%.

The InvestEU programme also plays an important role and is being rolled out. It is a powerful tool to generate private investments with a positive climate and environmental impact.

The green transition will also be vital for Europe’s recovery.

This is why we made green and sustainable projects a focus of our recovery plan: Next Generation EU. Its main financing tool, the Recovery and Resilience Facility, will spend 37% of its funding on climate mainstreaming and green projects.

However, we know that public money will not be enough. So, we have to rely on the private sector.

And this is why sustainable finance is so important: to generate investments to support sustainable growth and for Europe to make a real difference on climate change.

We are pushing ahead with our taxonomy classification system for sustainable economic activities – the world’s first. Here, I want to commend the European Parliament for approving the first climate taxonomy system.

The EU’s voluntary green bond standard is aligned with the taxonomy system. All issuers, in Europe or outside, can use it to help attract sustainable investments.

Through NextGenerationEU, the EU will also make a significant step towards financing the Green Deal and green transition by becoming the world’s largest issuer of green bonds.

On sustainability, we have created rules to improve the way that companies and financial market participants disclose how climate and environment affect their business and investments. And vice-versa too: how their activities affect climate and the environment.

The EU will also use its trade agreements to speed up cooperation on climate action and other environmental challenges – such as biodiversity and sustainable food systems.

We are proposing the inclusion of Paris climate commitments as a key element of trade negotiations. And we seek commitments for climate-neutrality in our negotiations with G20 countries.

Any transition of the scale that we envisage will also have a major social impact, for generations to come.

So, it must be fair and inclusive, not leaving any vulnerable region or people behind.

That is why we created the Just Transition Mechanism: a package of financial and practical support to assist those most affected by this major socio-economic transformation.

And we have proposed a new Social Climate Fund to support the most vulnerable in the green transition.

We designed the Sustainable Europe Investment Plan to make the EU’s green transition a reality.

It has global implications too.

Some EU initiatives may inspire other countries and International Financial Institutions to move in the same direction.

So, we will work with all like-minded partners on sustainable finance to make sure that our international work is coherent and ambitious. The International Platform on Sustainable Finance is a good example of a forum for global cooperation on sustainable investments and finance.

I commit to building a coalition of trade ministers across the globe who want to take action to promote trade in green goods and services. And more broadly, to promote trade and sustainability as a way to help us reach our climate and environmental objectives.

To take this forward, I will call for a ministerial meeting devoted to trade, climate and sustainability next year and I look forward to a productive discussion.